Short Term Business Loans - 4 Myths Busted

Call us on 1300 135 212 and let’s talk about your Short Term Business Loans scenario. You’ll be surprised at how easy we are to do business with!

Call us on 1300 135 212 and let’s talk about your Short Term Business Loans scenario. You’ll be surprised at how easy we are to do business with!

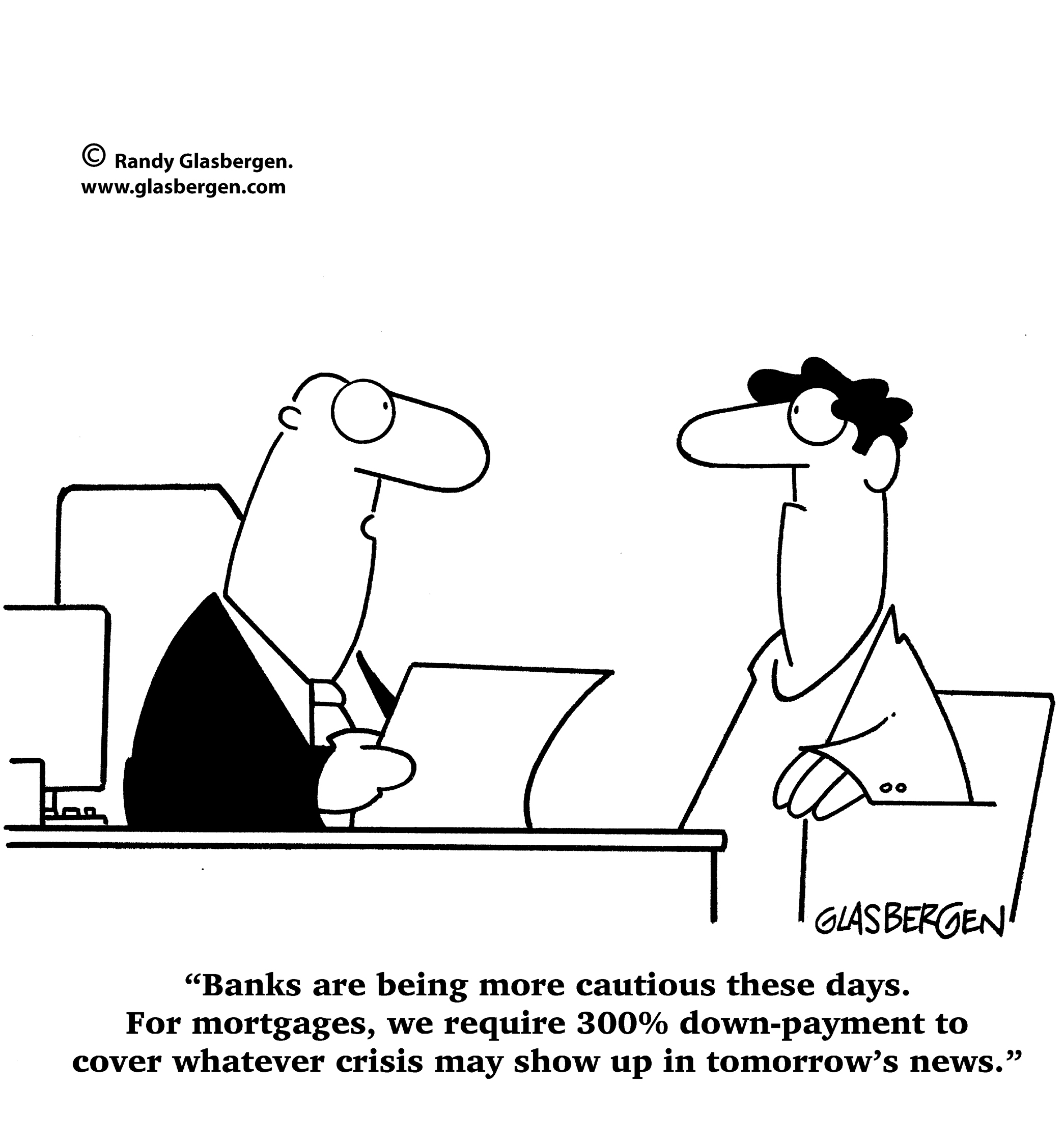

A question we’re very often asked is “why doesn’t a borrower just go to his bank?!” Read on and find out.

This article highlights just three of the many ways in which short term business loan finance can help your organisation achieve your long-term business goals. Consider these points when assessing your options in raising cash for urgent short term business needs. Read more to find out benefits of short term business loans include meeting working capital needs, funding a long term solution.

What should borrowers look for when choosing a third tier business lender?

So, what are the benefits to brokers of a strong relationship with a short term lender like Quantum Credit?

Are digital marketing and social media 'dark arts' with no real pay back - or are they essential components of any marketing strategy in this day and age?

The correlation between sporting prowess and business acumen is now widely accepted - from boardrooms to business management institutes - more

There are five broad scenario categories where a short-term loan is likely to be the best solution.

Banks go through phases. One of them, the “cleansing” phase, is where they exit any business that no longer fits their lending covenants – illogical as it may sometimes seem.

We’re not talking about businesses that have ...

Have you ever scratched your head in disbelief at what the banks are doing to your clients?

As short term lending specialists, the concern we have at Quantum Credit is that the banks take severe action too often against companies that remain viable.

When one of your clients becomes a candidate for a short-term loan remember that your advice and guidance will be key to its success.

Structuring a funding scenario that involves...

Often a borrower’s needs are not met because the broker, under the misapprehension that the short term loan process is too complex...

Why are some brokers active short-term loan advocates while other are not? Is short term funding too often overlooked? We maintain that...

The cheapest option for borrowers in most loan scenarios is going to be bank funding – if it is available timeously and on the right conditions. However, if...

The cheapest option for borrowers in most loan scenarios is going to be bank funding – if it is available timeously and on the right conditions. However, if...