Why Arent All Brokers Short-Term Loan Advisors?

Why are some brokers active short-term loan advocates while other are not? Is short term funding too often overlooked? We maintain that it is and there are several possible reasons:

• UNINFORMED: Many brokers are simply not fully informed about the availability and operation of short-term lending,

• HABITUATED: Even if a borrower’s requirement may in fact be best suited to a short-term loan from a specialist short-term lender, a broker may suggest a medium-term bank loan and an early payout settlement; because that’s the only approach they know. This can result in delays in the timing of loan advance, early exit fees and costs payable by the borrower, and a clawback of commission and termination of trail income for the broker,

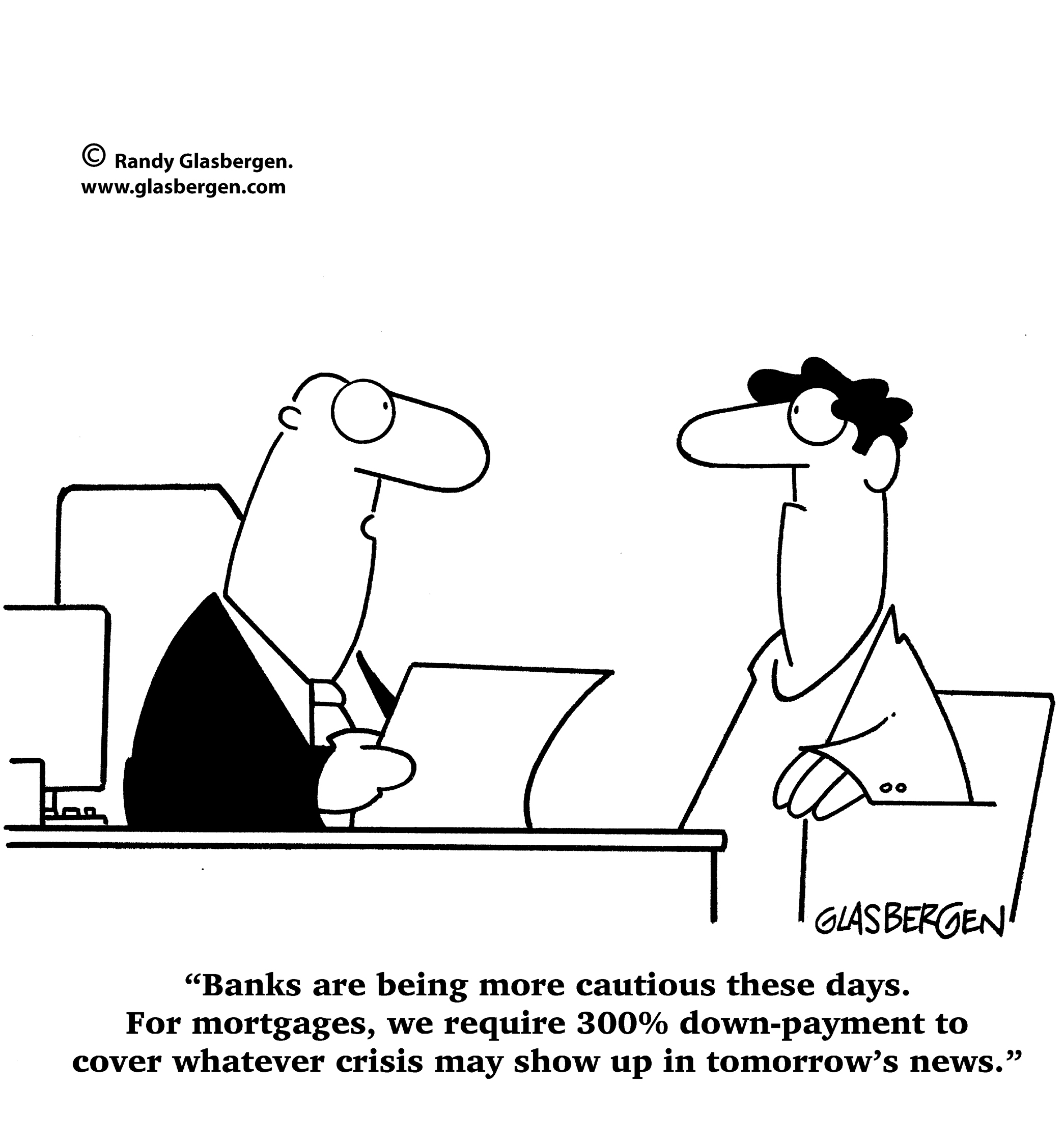

• STIGMA: Some brokers view all short-term lenders as loan sharks who take advantage of desperate borrowers, trapping them into a cycle of expensive debt. The association of short-term lending with unethical practices is common, in part due to its perceived premium cost. The fact is that responsible short-term lending is not expensive if, as discussed in other posts, the business benefits arising from a short term loan outweigh the costs,

• ASSUMPTIONS: Some brokers assume that short-term lending is hard. In the right lender’s hands, this assumption is not accurate. Often banks let a broker down at the last minute and this leads to an urgent need to find a solution, usually from a short term lender. While time constraints are stressful, we at Quantum Credit differentiate on our speed of turnaround and the flexibility of our approach - we make the process easy,

• PERCEPTION: Some brokers erroneously conclude that if the banks won’t provide short-term funding no one else will. Wrong! Specialist short-term lenders adopt a very different approach to banks. Specifically, we lend mainly on assets as opposed to income and we concentrate on the exit strategy – not all brokers know this.

Remember, a broker’s role is to act in the best interest of their client, to provide advice, and to place options on the table. It is not to make a decision for the client. If a client can understand and accept the “commercial decision” to take a slightly higher price structure, and often less demanding covenants, to achieve a longer-term profit/gain - then why should they be prevented from considering this solution?

To find out if we can help with your short-term funding needs, “Let’s Talk”. Give our team at Quantum Credit a call and put our experience to work. Contact Us