Loan scenarious sometimes makes for strange bedfellows

Leading short-term lender, Quantum Credit Business Development Executive, Rhode Truter says one valid perspective on the crucial role of short-term lenders is; "they look after banks' customers" by providing short-term funding solutions that otherwise may be unavailable.

Any notion that banks and short-term lenders are competitors is inaccurate, says Truter.

"Quantum Credit prides itself on having the financial resources and skills to develop creative, customised, temporary solutions to bridge gaps in bank funding," he says.

"Around 40 per cent of our loans are settled by banks and other funders, meaning we supply a vital, interim lending option for banks' business and investment customers."

Truter admits banks may not acknowledge this collaborative relationship but says the reality is reputable, specialised, Short-term lenders such as Quantum Credit can be vital components of a loan scenario and should certainly be part of a broker's solution suite.

Bank finance is generally the cheapest option. But the cold, hard fact is that bank funding is not always on the table and even if it is, the terms and timeframe may be unsuitable, resulting in costly missed opportunities, a good credit record sullied or a project falling over.

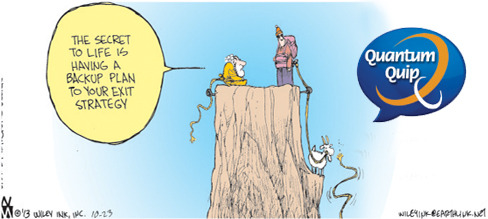

"short-term lenders such as Quantum Credit, established in the lending arena for 13 years, are part of a continuum of solutions for borrowers in need. We can represent a collar around a bank relationship," says Truter.

"A number of brokers don't recognise this. They don't appreciate the value of a short-term solution or identify opportunities to put customers in a short-term loan either on-the-way-into or on-the-way-out-of a bank relationship. This is frustrating for us and potentially a needless loss for brokers and their clients."

An example of an on-the-way-into a bank relationship scenario is a borrower presented with a business opportunity that requires prompt servicing. Banks cannot accommodate because they need months to process a loan application.

An on-the-way-out-of a bank example is a bank running out of appetite to extend funds or a loan gone bad - the borrower has a tarnished record and the bank wants to extricate the borrower post haste.

When a short-term lender such as Quantum Credit steps into the situations outlined above, years of expertise and processes specifically designed to deliver fast, flexible shot-term funding are employed. In all instances the short-term funder's relationship is with bank clients.

Quantum Credit possesses expertise in a specialised lending niche that mainstream bank lenders traditionally do not address well asset-rich borrowers who need short-term funding quickly and do not meet standard liquidity or credit requirements. In these situations, Quantum Credit applies an asset-based-lending approach to its loan assessments, focussed on exit planning and taking the view that the equity in the property asset security will be sufficient to cover risks in the event of default.

"Without successful lenders like Quantum Credit that operate in a specialist financing space and boast a record of responsible lending and commitment to service, it would be a lose/lose/lose (borrower/broker/bank) all round," Truter says.

For further information re short-term loans call Quantum Credit 1300 135 212